SBA 1531 2008 free printable template

Show details

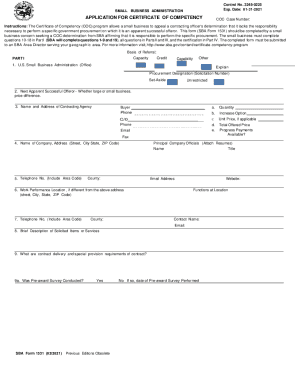

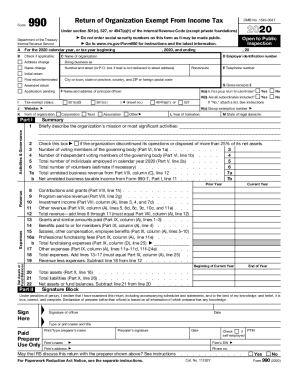

This form SBA Form 1531 should be completed by a small business concern seeking a COC determination from SBA that it is responsible to perform the specific contract. Are special skills required SBA Form 1531 05-08 Previous Editions Obsolete Yes No Total Manhours per week Are Employees with necessary skills FACILITIES AND EQUIPMENT Facility Area in sq. Control No* 3245-0225 Exp* Date 5/31/2011 SMALL BUSINESS ADMINISTRATION APPLICATION FOR CERTIFICATE OF COMPETENCY COC Case Number Instructions...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SBA 1531

Edit your SBA 1531 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SBA 1531 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SBA 1531 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SBA 1531. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SBA 1531 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SBA 1531

Point by point instructions on how to fill out a stimulus application form:

01

Begin by gathering all necessary documents and information. This may include your social security number, income details, and any other relevant financial information.

02

Carefully read and understand the instructions on the form. Pay attention to any specific eligibility criteria or requirements mentioned.

03

Fill in your personal information accurately. This typically includes your full name, address, contact details, and date of birth.

04

Provide your social security number or any other identification numbers requested.

05

Specify your current employment status and income details. This may include your employer's information, income sources, and any other relevant financial information.

06

If applicable, provide information about any dependents you have, such as their names, ages, and relationship to you.

07

If the form requires you to indicate your filing status, choose the appropriate option (e.g., single, married, head of household).

08

Carefully review your completed form for any errors or omissions. Make sure all information provided is accurate and up-to-date.

09

Sign and date the form as required. This may involve an electronic signature or a physical signature depending on the submission method.

10

Ensure that you have included any necessary supporting documents, such as proof of income or identification, as instructed.

Who needs a stimulus application form:

01

Individuals or households who meet the eligibility criteria specified by the stimulus program.

02

Those who have experienced financial hardships or economic challenges due to specific circumstances, such as a natural disaster or a global economic downturn.

03

Individuals seeking financial assistance or relief from the government to help stabilize their financial situation or stimulate economic recovery.

Fill

form

: Try Risk Free

People Also Ask about

How to get stimulus check 2022 without filing taxes?

Even if you don't owe taxes or have no income, you can still get this full tax credit. Fill out the IRS Non-filer tool to get the advance CTC or missed stimulus checks if you are don't need to file a 2020 tax return.

What form do I need to fill out to get my stimulus checks?

You can include additional changes to your originally filed return on the “Stimulus Payment” Form 1040X.

Can I apply for my stimulus?

If you didn't receive the most recent stimulus payment, you can claim it when you file your 2021 tax return.

How do I get a stimulus check 2022?

You will need to file a 2020 tax return to get the first and second stimulus checks and a 2021 tax return to get the third stimulus check. To claim your first, second, or third stimulus checks, wait until the 2023 tax season begins to get help filing your 2020 or 2021 tax return.

Do I have to file a form to get my stimulus check?

You will need to file a tax return for Tax Year 2020 (which you file in 2021). The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021. If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks.

What form is the 6475?

A: The Letter 6475 confirms the total amount of the third stimulus check (Economic Impact Payment) and any plus-up payments you received for tax year 2021. If you received joint payments with your spouse, the letters show the total amount of payment.

Do I have to fill out an application for stimulus check?

Some people will get their check automatically. Others will have to register with the IRS. Eligible adults, who have not yet registered or received their stimulus payment, must register with the IRS by October 15, 2020 in order to get their payment this year.

How do I claim the new stimulus check?

You will need to file a tax return for Tax Year 2020 (which you file in 2021). The deadline to file your taxes was last October 15, 2021. If you missed the October 2021 filing deadline, you can still file your tax return to get your first and second stimulus checks.

What happens if you didn't get a letter 6475?

What if I never received Letter 6475 or lost it? If you never received a third stimulus check, the IRS didn't send you Letter 6475. If you were eligible and didn't get a payment in 2021, you can get those funds now by claiming the recovery rebate tax credit on your 2021 tax return.

Are we getting a stimulus check in July 2022?

State leaders say an estimated 23 million people qualify for the checks, which will be sent out between October 2022 and January 2023. The payment is only available to residents who have lived in California for at least 6 months in the 2020 tax year or who are living in the state by the time the check is issued.

Can I still get stimulus money?

Thankfully though, the IRS says that some eligible taxpayers may be able to get missed stimulus payments. Depending on your circumstances, you may still be able to file a 2021 tax return to find out if you're eligible to get your stimulus payment, the 2021 child tax credit, or the earned income tax credit.

How to find letter 6475?

A: If you did not receive your Letter 6475, you can check Your IRS Online Account to securely access your individual IRS account information. The amount of your third Economic Impact Payment is shown on the Tax Records tab/page under the section “Economic Impact Payment Information”.

Where do you put the stimulus check on 1040?

You report the final amount on Line 30 of your 2021 federal income tax return (Form 1040 or Form 1040-SR).

What form do I fill out for my stimulus check?

You can include additional changes to your originally filed return on the “Stimulus Payment” Form 1040X. However, the only information that will be used to figure your stimulus payment amount is the information on your original return and the qualifying income you reported on this Form 1040X.

Will we get a stimulus check in 2022?

"Taxpayers will not receive an additional stimulus payment with a 2023 tax refund because there were no Economic Impact Payments for 2022."

Who is getting stimulus money in 2022?

How much California residents received is based on their income, tax-filing status and household size. Single taxpayers who earn less than $75,000 a year and couples who file jointly and make less than $150,000 a year will receive $350 per taxpayer and another $350 if they have any dependents.

How do I claim a stimulus check?

You will need to file a 2020 tax return to get the first and second stimulus checks and a 2021 tax return to get the third stimulus check. To claim your first, second, or third stimulus checks, wait until the 2023 tax season begins to get help filing your 2020 or 2021 tax return.

What form is the stimulus payment on?

Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit. Having this information will help individuals determine if they are eligible to claim the 2020 or 2021 Recovery Rebate Credit for missing stimulus payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get SBA 1531?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the SBA 1531 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for the SBA 1531 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your SBA 1531.

How do I fill out SBA 1531 on an Android device?

Use the pdfFiller Android app to finish your SBA 1531 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is SBA 1531?

SBA 1531 is a form used by the Small Business Administration (SBA) to report and track certain financial information regarding businesses that have received loans or federal assistance.

Who is required to file SBA 1531?

Businesses that have received SBA loans or federal assistance are required to file SBA 1531 to ensure compliance with financial reporting requirements.

How to fill out SBA 1531?

To fill out SBA 1531, gather the necessary financial documents, follow the instructions provided with the form, and accurately complete each section with the required financial data and information about the business.

What is the purpose of SBA 1531?

The purpose of SBA 1531 is to collect financial and operational information from businesses that have received federal assistance, helping the SBA to assess compliance and monitor the impact of its programs.

What information must be reported on SBA 1531?

The information that must be reported on SBA 1531 includes details about the business's financial performance, loan specifics, and any other required data that demonstrates how the federal assistance has been utilized.

Fill out your SBA 1531 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SBA 1531 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.